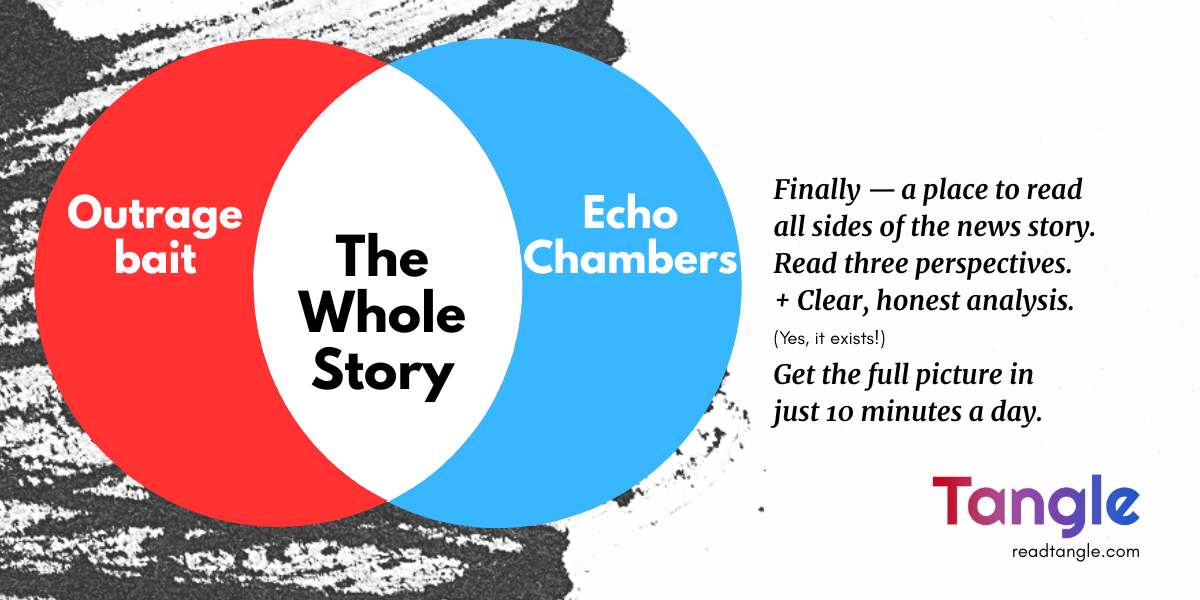

Most political news lives in the extremes.

It’s either rage bait meant to rile you up, or echo chambers that only reinforce what you already believe. The result? More division, less understanding — and a lot of burnout.

We give you the full story on one major political issue a day, broken down with arguments from the left, right, and center — plus clear, independent analysis. No spin. No shouting. No bias disguised as truth.

In just 10 minutes a day, you’ll actually understand what’s happening — and how all sides see it.

Join 400,000+ readers who are skipping the noise and getting the full picture.

Happy Thursday folks!

Here is my favorite passage of the week, two quotes and book of the week with two important lessons to ponder on:

Passage of the Week:

Author and Keynote Speaker Darren Hardy on finding and engaging a mentor:

From The Compound Effect by Darren Hardy

Two Quotes:

“The power of positive thinking is the ability to generate a feeling of certainty in yourself when nothing in the environment supports you.”

“Dwell on the beauty of life. Watch the stars, and see yourself running with them.”

Book of the Week with 2 Important Lessons:

The book of the week is How Not to Invest: The ideas, numbers, and behaviors that destroy wealth and how to avoid them by Barry Ritholtz.

A clear, compelling and brilliant read. This book highlights the most common errors investors make and designed to reduce mistakes. Our mistakes with money. Tiny errors, epic fails, and everything in between. You can do thousands of things right, but make just a few of the errors we discuss, and you destroy much of your portfolio. If you could learn how to avoid the unforced errors investors make all the time, you would make your life so much richer and less stressful.

The counterintuitive truth is that avoiding errors is much more important than scoring wins. The book shows us a few simple tools and models that will help you avoid the most common mistakes people make with their money. Learn these, and you are ahead of 98% of your peers. Make fewer errors, end up with more money.

Few authors write about finance with such clarity. One of my favorite books of 2025. I highly recommend it!

Here are two important lessons from the book:

1) Make Few Errors, Make More Money:

Berkshire Hathaway’s inimitable Charlie Munger phrased it this way: “It’s remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

All humans are fallible. That is the very nature of what it means to be human; we have a limited ability to see the future or even understand the past and present. We all make mistakes. We easily mistake randomness for skill. We imagine we see the future when we hardly understand today. We readily convince ourselves we are in control of our own destinies, when nothing could be further from the truth. Recognizing our own ignorance is an advantage.

These days, there is an endless torrent of media advice. It’s an overwhelming fire-hose of speculation and opinion. Most of it can be safely ignored. The experts are no better than the public at large. Expert forecasts are statistically indistinguishable from random guesses. What should investors do instead of paying attention to the unsupported, mostly wrong, exercises in futility called forecasting? At very least, Barry suggest three simple things:

A well-thought financial plan that is not dependent upon correctly guessing what will happen in the future.

A broad asset allocation model that is Core & Satellite: Mostly passive indexes, plus whatever ornaments you might want on the tree. Re-balance every few years. Repeat forever.

Cut the useless, distracting noise in your media diet.

It is important for investors to understand what they do and don’t know. Recognize you cannot know what is going to happen in the future, and any investment plan that is dependent on accurately forecasting where markets will be next year is doomed to failure. Never forget this simple truism: All forecasting is marketing, plain and simple.

Bad advice comes in many flavors. The best way to avoid it is to ask one simple question to yourself: “What is this person selling?” Once you figure out what the product is, you can put the sale “advice” into better context. Most important of all, none of this “free” advice should ever be the basis of your investment decisions. It’s your money, no one benefits from its growth more than you. Be responsible for it.

2) 10 Steps to Become a Better Investor:

There are many ways to outsmart our instincts and avoid the bad ideas, misleading numbers, and poor behavior that lead to mediocre results. Here are the ten steps to achieve better outcomes:

Avoid mistakes (fewer unforced errors, be less stupid).

Recognize your advantages (and take advantage of them).

Create a financial plan (then stick to it). If you need help, find someone who is a fiduciary to work with.

Index (mostly). Own a broad set of low-cost equity indices for the best long-term results.

Own bonds for income and to offset stock volatility. Primarily Treasuries, investment-grade corporates, munis, and TIPs.

Be tax-aware. Consider direct indexing to reduce capital gains and reduce concentrated positions. With outsized single position gains, use a regret minimization strategy.

Be skeptical of all but the best alts (VC/PE/HF/PC). If you have access to the top decile, take advantage of it. Otherwise, exercise caution.

Spend your money intelligently: Buy time, experiences, and joy. Ignore the scolds.

Fail better. Understand what is and is NOT in your control.

Get rich: Here are the classic strategies to get rich in the markets, including how difficult each is and their likelihood of success.

It has taken decades for Barry to accumulate the stories, insights, and wisdom shared in this book. I highly recommend the book and if you implement these ideas, you will become wealthier, happier, and much less stressed about your financial circumstances.

Book I am currently reading:

Living Untethered: Beyond the Human Predicament by Michael A. Singer. A transformative and highly anticipated guide that will be your compass on an exciting new journey toward self-realization and unconditional happiness.

READING TIP: Schedule Time for Daily Reading

Make time for reading in your daily routine. Schedule reading into your day like you do for a meeting at whatever time works for you. Read during your mornings, at lunchtime, or before you head to bed.

I read mostly in my mornings as it sets up the tone for my day ahead.

Thank you for reading and all your support.

I am excited to keep bringing you the new and old books, great insights, and lessons.

Until next week, stay curious and happy reading!

— Ravi Shah | @readswithravi